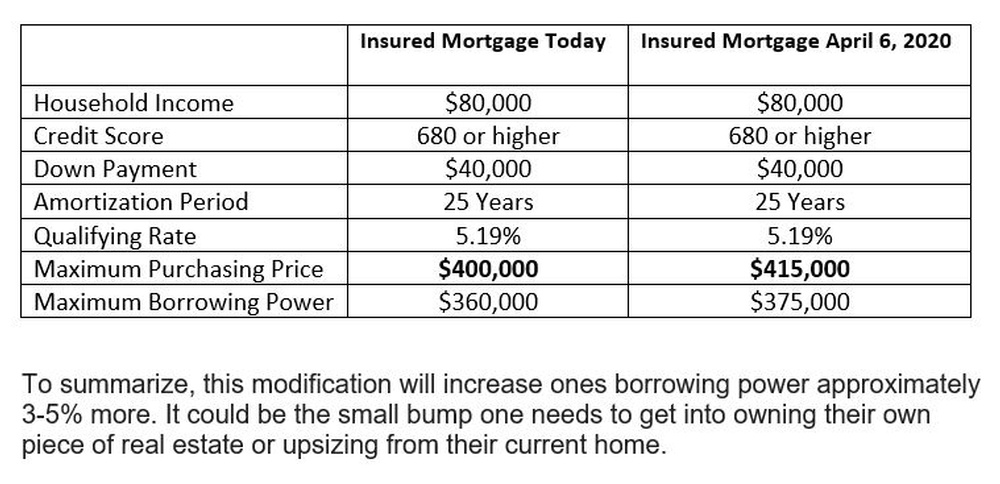

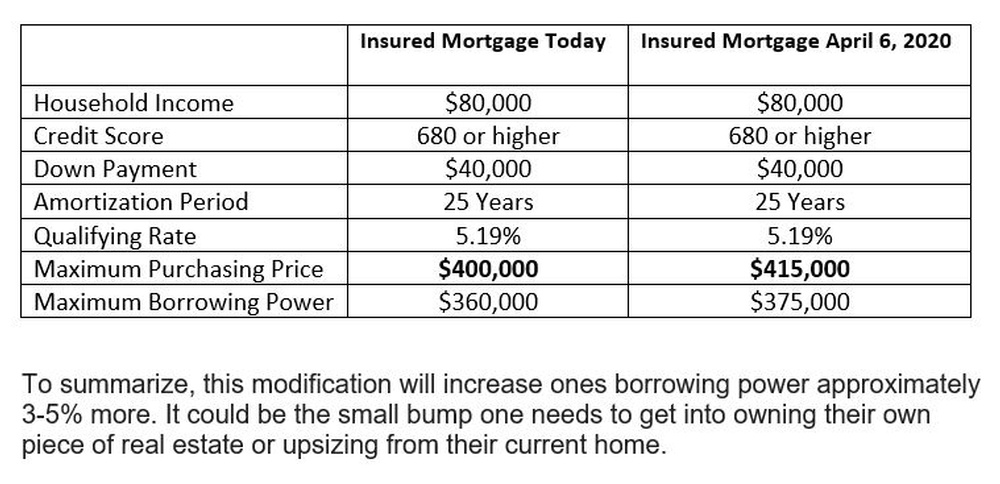

Good News! The stress test is being lowered. Its not tremendous but its certainly a step in the right direction. We have yet another new borrowing guideline that the federal government is amending on April 6,2020. Here is the list of the summarized details: • Applies to borrowers seeking financing with less than 20% down payment for insured mortgages • Not just for first time home buyers, but everyone with less than 20%. • Overall qualifying rate will be reduced by approx 30 basis points or 0.30% currently at 5.19%. • This change is being made to bring the qualifying rate more in-line with the housing…

-

Stress Test is changing

-

Canadian Mortgage Rates are at a 2 year low

Fixed-rate mortgages are now almost as cheap as variable rate and that's very unusual. The lowest fixed rate available today is 2.64% and it hasn't been this low in over 2 years. Five year fixed rates are now almost at the same level as variable rates. Now is the time to buy and most certainly the time to have a mortgage review and get rates locked in for your renewals or refinances. Call today to get started. This call can literally save you thousands.

-

The Lowest Rate Isn't always the best rate!

The lowest mortgage rate can end up costing you thousands! Here's how: Often times, the lowest rates come with restrictions. What are the restrictions attached to the mortgage? Most banks will offer restrictive terms on the most attractive rates. These restrictions can include: 1. No prepayment privileges or less of a prepayment privilege 2. Higher penalties to exit the mortgage 3. No option to refinance the mortgage 4. A sale clauses like the inability to break your mortgage unless you sell Considering 7/10 will break their mortgage within 3 years these fees can be astronomical and end up costing you thousands. Be sure your mortgage options are suitable…